The Trump’s tariff plan proposal to impose tariffs exceeding 25% on semiconductors is poised to disrupt the global semiconductor industry. Particularly it will impact South Korea’s memory chip sector. Trump’s tariff plan is targeting both memory chips and foundry services. This policy has sparked concerns among major industry players such as Samsung Electronics, SK Hynix, and Taiwan Semiconductor Manufacturing Company (TSMC). In modern technology, these semiconductors have a major role. The complications of these tariffs extend far beyond trade relations. It will influence the supply chain, production strategies and competitive dynamics.

Table of Contents

Trump’s Tariff Plan influence on South Korean Chipmakers

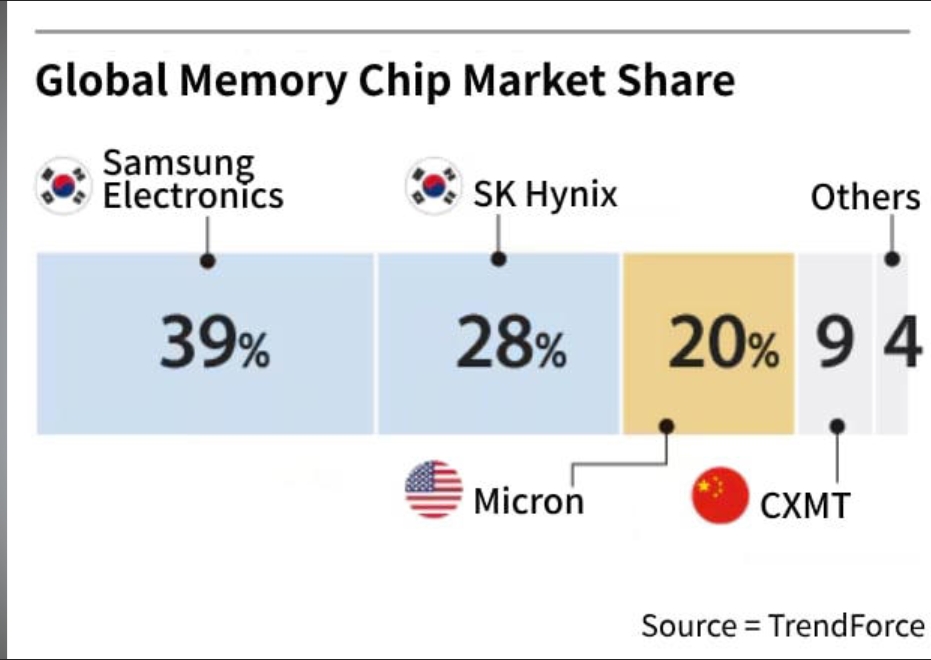

South Korea has long been a dominant force in memory chip production. In the last year, it has supplied $10.7 billion worth of semiconductors to the U.S. and memory chips comprised about 79% of that total.

The proposed tariff could reduce this market share, making South Korean companies find new ways to compete. Although Samsung and SK Hynix produce DRAM and NAND flash memory in both South Korea and China, about 70% of their total production comes from South Korean factories.

The prices of foundry services can be adjusted based on customer needs, but memory chips are very sensitive to price changes. Even a small price increase can make it harder for companies to compete.

To avoid tariffs, companies must move semiconductor production to the U.S., but this is not an easy solution. Samsung’s factories in Austin and Taylor, Texas, focus on foundry work. Also, SK Hynix’s U.S. plant does not make memory chips. Because of this, memory chips made in South Korea and sold in the U.S. will still face tariffs.

Micron’s Competitive Edge

The Trump’s Tariff plan comes at a time when Micron Technology is expanding in the U.S. Micron will start making memory chips in Idaho next year. The U.S. chipmaker is also investing $125 billion in large-scale memory plants in Idaho and New York. The New York plant will start production in 2028. This positions Micron to dominate the U.S. market.

If Trump’s tariff plan takes effect, Micron could take a large share of the U.S. memory chip market. Since memory chips are similar in quality, even small price changes can influence buyers. A tariff- driven price increase could push customers toward Micron’s products. Experts warn that Samsung and SK Hynix will struggle to compete. Establishing memory chip plants in the U.S. is not a straightforward option for South Korean firms, as Samsung and SK Hynix are already focused on expanding their foundry capacity. Constructing a new memory facility would take four to five years, and companies must weigh the risk of oversupply given their existing memory fabs in South Korea and China.

Rising Competition with Trump’s Tariff plan

South Korean Chipmakers also face rising competition from Micron. Last year, Micron had only 3% of the High-band memory (HBM) market, while SK Hynix held 65% and Samsung 32%. As Micron is growing fast, its new HBM3E 12-layer chips are said to be more power-efficient. With Nvidia as a major client, Micron aims to increase its HBM market share to 25% this year. Some analysts also believe Micron has surpassed Samsung in certain NAND flash technologies.

The foundry market is shifting as well. TSMC leads with 65% of the global market, while Samsung holds 9.3% and China’s SMIC has 6%. TSMC has a strong presence in the U.S. giving it an advantage in supplying American companies like Nvidia and Qualcomm. TSMC is also considering buying Intel’s foundry business. This move would further strengthen its market position and reduce the impact of tariffs.

Possible Consequences of Trump’s Tariff Plan

The U.S. government has not yet clarified that in Trump’s tariff plan which countries or semiconductor products will face tariffs. But if the new tariffs follow Trump’s previous steel and aluminum policies, South Korea’s semiconductor industry could suffer major losses.

The final impact will depend on whether these tariffs apply to all foreign chipmakers, including Micron. If they do, South Korean firms may not be at a disadvantage. However, Micron’s growing U.S. production could still shift the market in its favor.

Samsung and SK Hynix must find ways to reduce the impact of these tariffs. They may need to increase production in non-tariff regions, invest in better technologies and expand their product lines. As trade policies evolve, companies must act fast to stay competitive in an increasingly complex market.

2 thoughts on “Trump’s Tariff Plan: Implications for the Semiconductor Industry”